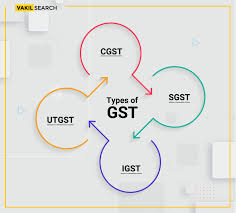

Types of GST Tax

We have two types of GST transactions, intra-state and inter-state, to ensure equitable tax distribution between the Central and State Government while simplifying tax compliance for businesses, promoting economic unity, and streamlining the taxation of goods and services across India.

- Inter-state transactions: This transaction occurs between 2 different states. The Central Government collects GST in the form of IGST from the taxpayer and further distributes / allocates the proportionate share to the respective State Governments.

- Intra-state transaction: This transaction occurs within the same state only. Here the GST is divided between the Central and the respective State Government as CGST and SGST

Thus, on the basis of the differentiation between interstate and intrastate transactions, it is determined which type of GST will apply, CGST (Central Goods and Services Tax) or SGST (State Goods and Services Tax) or IGST (Integrated Goods and Services Tax) or UTGST (Union Territory Goods and Services Tax).

Types of GST in India

There are 4 types of GST in India, they are:

- CGST (Central Goods and Services Tax)

- SGST (State Goods and Services

- IGST (Integrated Goods and Services Tax)

- UTGST (Union Territory Goods and Services Tax)

The GST/ taxation rates for particular goods (identified by HSN) and services (identified by SAC) remains constant across India, only the methodology of application of GST differs based on the interstate (IGST) or intrastate supply (CGST + SGST). To understand the types, one must keep in mind that GST is a destination-based tax and the burden of tax is on the ultimate consumer. Thus, the GST amount is received by the destination state i.e. state where the goods are actually consumed and not by the state, where the goods originated from or were manufactured.

Let's look deeper into the various types to get a clear understanding on what is CGST, SGST, IGST and UTGST?

Components of GST and its Explanation

- CGST (Central Goods and Services Tax): CGST is the tax collected by the Central Government. It is similar to SGST in the sense that it is also collected on an intrastate transaction (within the same state). All businesses that are registered under the GST system must file CGST returns on a regular basis and must include information on their intra-state transactions in the filings.

For instance: When a businessman from Madhya Pradesh sells items for Rs. 5,000 to a consumer in Madhya Pradesh, then equal parts of CGST and SGST will apply to the transaction. If there is an 18% GST charge, it will be split 9% into CGST and 9% to SGST. In this instance, the supplier would charge total of Rs.5,900 where Rs,5,000 is the taxable value and Rs.900 is the total GST amount which is equally distributed between the Central Government as CGST Rs. 450, and similar amount to the State Government as SGST.[1]

- SGST (State Goods and Services Tax): Similar to CGST, SGST is the tax collected by the state Government through an intrastate transaction. However, the state imposes SGST only on any commodities or services that are bought or sold within the state. The money collected through SGST is claimed and governed only by that state. After the introduction of the GST system, many state-level indirect taxes were subsumed into the SGST, simplifying the tax structure within each state. However, SGST is not a single, unified tax, and states retain the power to levy certain additional taxes.

For instance: As per the example provided above, GST is split equally between Central and State Governments in intrastate transactions. The merchant would charge a total of Rs. 5,900, and the State Government will charge GST in the form of SGST of Rs. 450, similar to the Central State Government.

- IGST (Integrated Goods and Services Tax): It is a tax under the GST system that is imposed on imports, exports, and interstate (between two states) sales of goods and/or services. The Central Government collects GST in the form of IGST.

For instance: When a businessman from Madhya Pradesh sells items for Rs.5,000 to a consumer in Uttar Pradesh, then IGST will apply to the transaction. If there is an 18% GST charge, the merchant would charge a total of Rs.5,900. IGST will be Rs.900 and will be collected by the Central Government.

Thus, to differentiate between SGST, CGST and IGST; On one hand, CGST and SGST apply to intrastate transactions (inside the same state) while IGST applies to interstate transactions (between different states). Further, in intrastate transactions, GST is divided equally between the Central and State Governments in the form of CGST and SGST, as explained above. Whereas GST under interstate transactions is collected only by the Central Government in the form of IGST.[2]

- UTGST (full form- Union Territory Goods and Services Tax): UTGST is imposed on the supply of products and/or services in the Union Territories (UTs) of India. In the Andaman and Nicobar Islands, Chandigarh, Daman Diu, Dadra Nagar Haveli, and Lakshadweep, products and/or services are subject to the UTGST. The Union Territory Government is in charge of collecting the UTGST revenues.

It is important to note here that there is no specific SGST, CGST, UTGST, or IGST rate, the GST rate is fixed at various slabs of 5% GST, 12% GST, 18% GST, and 28% based on the supply made determined by HSN or SAC. Once the GST is calculated and paid, it is distributed to the Central, State, and UT depending on the nature of the transaction.

Difference Between Types of GST

|

Type of GST

|

Jurisdiction

|

Applicability

|

Authority benefited

|

Priority of text credit use

|

|

CGST

|

Central Government

|

Intra-state transactions

|

Central Government

|

CGST

IGST

|

|

SGST

|

State Government

|

Intra-state transactions

|

State Government

|

SGST

IGST

|

|

IGST

|

Central Government

|

Inter-state transactions

|

Central Government

|

IGST

CGST

SGST

|

|

UTGST

|

UT Government

|

Intra-union territory transactions

|

Union Territory (UT) Government

|

UTGST

IGST

|

Taxes Replaced by GST

GST was introduced with a vision of “One Nation, One Tax” to minimise the complexity of multiple registrations for indirect taxes. Thus, GST merged many Central and State indirect taxes together such as:

|

Central Taxes

|

State Taxes

|

|

● Central excise duty

● Central sales tax

● Service tax

● Additional duties of customs

● Additional duties of excise

● Excise duty levied under the textile products

|

● Purchase tax

● Entry Tax

● VAT

● Surcharge and Cess

● Taxes on lottery, gambling and betting

● Taxes on advertisements

● Luxury Tax

● Entertainment Tax

|